Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ma massachusetts?

Massachusetts is a state located in the New England region of the United States. It is one of the 50 states and is known for its rich history, prestigious universities, and vibrant culture. The capital of Massachusetts is Boston, which is also the largest city in the state and serves as an economic and cultural hub. Massachusetts played a significant role in the American Revolution and is home to historic sites such as the Boston Tea Party, Plymouth Rock, and the Salem Witch Trials. The state is also known for its renowned educational institutions, including Harvard University, Massachusetts Institute of Technology (MIT), and Boston University. Massachusetts is bordered by the Atlantic Ocean to the east and is also adjacent to the states of New Hampshire, Vermont, Connecticut, Rhode Island, and New York.

Who is required to file ma massachusetts?

In general, all residents of Massachusetts are required to file a state tax return if their income exceeds certain thresholds. Additionally, non-residents who earn income from Massachusetts sources may also be required to file a state tax return.

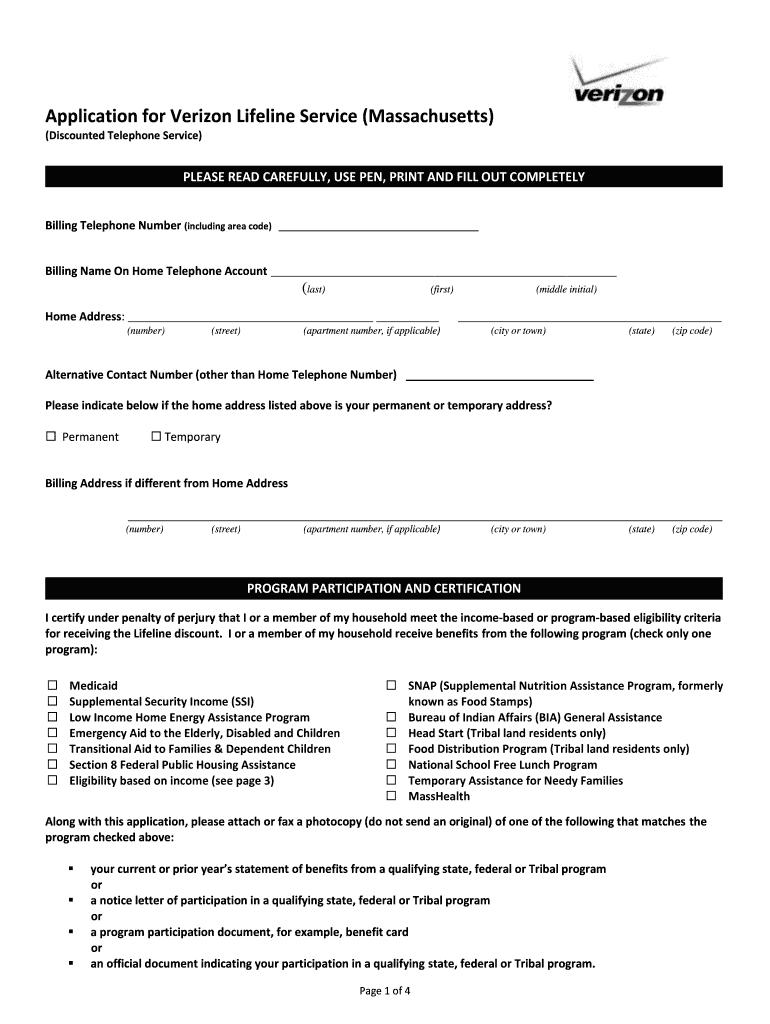

How to fill out ma massachusetts?

To fill out a Massachusetts (MA) tax form, follow these steps:

1. Gather documents: Collect all necessary documents including W-2 forms, 1099 forms, and any other relevant income or deduction records.

2. Download the form: Visit the Massachusetts Department of Revenue website and download the appropriate tax form based on your filing status. Common forms include Form 1 (for residents) or Form 1-NR/PY (for non-residents or part-year residents).

3. Provide personal information: Fill in your name, address, social security number(s), and other required identifying information. If applicable, include your spouse’s information as well.

4. Determine filing status: Indicate your filing status (single, married filing jointly, married filing separately, head of household). Ensure to check the box that corresponds to your situation.

5. Report income: Enter the income details as per the provided instructions. Include wages, salaries, tips, interest, dividends, retirement income, and any other applicable income sources.

6. Claim deductions and exemptions: Deduct eligible expenses and exemptions to lower your taxable income. Common deductions include student loan interest, mortgage interest, property tax, and contributions to retirement accounts.

7. Calculate taxes: Use the provided tables or tax calculators to determine your tax liability based on your income and filing status. Note that Massachusetts has a progressive tax structure with varying tax rates.

8. Tax credits: Check if you qualify for any tax credits, such as the Earned Income Credit, Child and Dependent Care Expenses Credit, or the Residential Energy Credit.

9. Review and sign: Double-check all the information you’ve entered to ensure accuracy. Once satisfied, sign and date the form.

10. Submit the form: Send the completed form to the Massachusetts Department of Revenue. If filing electronically, follow the e-file instructions provided on the website. If mailing a physical form, use the address mentioned on the form or the Massachusetts Department of Revenue website.

Remember to keep copies of all documents and forms for future reference or in case of an audit. If you are unsure about any part of the process, consult a tax professional or contact the Massachusetts Department of Revenue for guidance.

What is the purpose of ma massachusetts?

The purpose of Massachusetts, as a state within the United States, is to serve as a political and administrative entity that provides governance, services, and representation to its residents. Massachusetts, commonly known as the Bay State, has multiple purposes, including:

1. Governance: Massachusetts functions as a self-governing entity, implementing laws, regulations, and policies to ensure the well-being and safety of its residents. It has its own state government, including a governor, legislature, and judiciary, responsible for the management and decision-making at the state level.

2. Representation: Massachusetts is represented at the national level by two Senators and nine Representatives in the U.S. Congress. These representatives work to voice the concerns and priorities of the state's citizens, advocating for their interests and participating in the federal decision-making process.

3. Social Services: Massachusetts is responsible for providing various social services to its residents, such as education, healthcare, transportation, public safety, and environmental protection. The state government allocates funds, creates policies, and establishes agencies to ensure the fulfillment of these services.

4. Economic Development: Massachusetts aims to foster a conducive business environment while promoting economic growth and prosperity. It supports industries such as technology, finance, biotechnology, education, and healthcare, attracting investments and creating job opportunities within the state.

5. Preserving History and Culture: Massachusetts is rich in history, playing a crucial role in the American Revolutionary War and being home to prominent historical figures. The state aims to preserve its historical landmarks, promote cultural diversity, and support the arts and humanities.

Overall, the purpose of Massachusetts is to govern its residents efficiently, represent their interests at the national level, provide essential services, stimulate economic growth, and preserve its unique historical and cultural identity.

What information must be reported on ma massachusetts?

In Massachusetts, certain information must be reported to comply with various laws and regulations. The specific information that needs to be reported may vary depending on the context and the reporting requirements involved. Here are some examples of information that may need to be reported in Massachusetts:

1. Taxes: Businesses and individuals must report their income and file tax returns with the Department of Revenue, reporting their earnings, deductions, and credits.

2. Unemployment Insurance: Employers are required to report employee wages and pay unemployment insurance taxes to the Department of Unemployment Assistance.

3. Workers' Compensation: Employers must report workplace injuries and provide information regarding workers' compensation insurance coverage to the Department of Industrial Accidents.

4. Financial Reporting: Certain types of businesses, such as corporations and nonprofit organizations, may need to report financial information to the Office of the Secretary of the Commonwealth, including annual reports, changes in corporate structure, and other relevant financial documents.

5. Environmental Reporting: Businesses may need to report their environmental compliance, such as hazardous waste management, air emissions, and water usage data to the Massachusetts Department of Environmental Protection.

6. Health and Safety Reporting: Organizations, including healthcare facilities, may be required to report infectious disease outbreaks, incidents, and other health-related information to the Massachusetts Department of Public Health.

7. Campaign Finance: Political campaigns and committees are required to report campaign contributions, expenditures, and related information with the Office of Campaign and Political Finance.

8. Securities Reporting: Companies issuing securities may need to file registration statements, periodic reports, and other disclosures with the Massachusetts Securities Division.

9. Data Breach Reporting: Businesses that experience unauthorized access or disclosure of personal information must report the incident to affected individuals, the Attorney General's Office, and the Office of Consumer Affairs and Business Regulations within the required timeframe.

These are just a few examples, and there may be additional reporting requirements depending on the industry, type of business, or specific circumstances. It is important to consult the relevant government agencies or seek legal advice to ensure compliance with the specific reporting requirements in Massachusetts.

What is the penalty for the late filing of ma massachusetts?

The penalty for late filing of Massachusetts tax returns can vary depending on the type of return and the amount of taxes owed. For personal income tax returns, the penalty for late filing is generally 1% of the unpaid tax per month, up to a maximum of 25%. Additionally, there may be interest charged on any unpaid tax. For business tax returns, such as corporate excise tax or sales/use tax, the penalties can vary but are usually a percentage of the tax owed or a flat fee. It is best to consult the Massachusetts Department of Revenue or a tax professional for specific penalty information based on your situation.

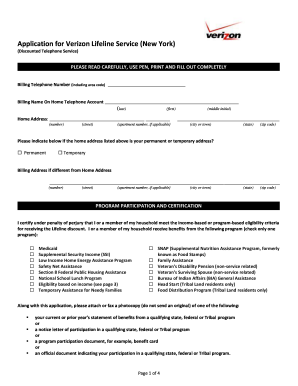

How do I make edits in ma massachusetts without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your application lifeline form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit lifeline service form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share massachusetts lifeline from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How do I edit massachusetts lifeline form on an Android device?

You can make any changes to PDF files, like verizon lifeline form, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.